We CONNECT

Empower Yourself with the Zogo App

Your Pathway to Financial Knowledge

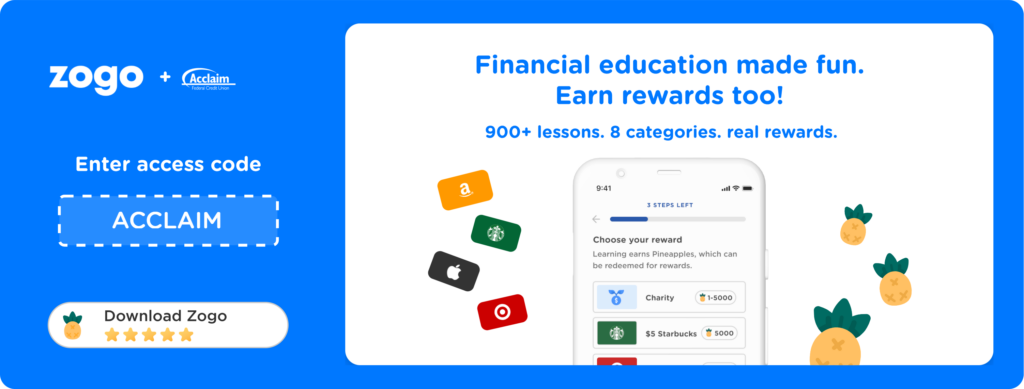

We are thrilled to introduce you to Zogo, the innovative financial education app that puts learning about money management right at your fingertips. Here at Acclaim FCU, we believe in empowering our members with the knowledge and tools they need to achieve financial wellness. Zogo is the latest addition to our commitment to providing you with valuable resources to make informed financial decisions.

What is Zogo? Zogo is not just another app—it’s a gamified financial literacy app that rewards users for completing bite-sized educational modules. When correctly answering questions following each module, users earn points in the form of pineapples they are able to exchange for gift cards to popular retailers.

Whether you’re a young adult just starting your financial journey or looking to deepen your understanding of money matters, Zogo offers interactive modules and quizzes that cover a wide range of topics, from budgeting basics to investing strategies.

How Does Zogo Work? The app features bite-sized modules that are fun and easy to digest. Each module focuses on a specific financial topic and is followed by a quiz to reinforce key concepts. By completing modules and quizzes, users earn points that can be redeemed for rewards—a great incentive to stay motivated and continue learning.

Why Use Zogo? Learning about personal finance can sometimes feel daunting, but with Zogo, it’s both educational and enjoyable. You can access the app anytime, anywhere, making it convenient to learn at your own pace. Whether you’re interested in mastering the art of saving, understanding credit scores, or planning for retirement, Zogo provides the knowledge you need to make informed financial decisions throughout your life.

Getting Started with Zogo Getting started with Zogo is simple:

- Download the Zogo app from the App Store or Google Play Store.

- Sign up using your [Your Credit Union Name] credentials.

- Start exploring modules and quizzes tailored to your financial interests and goals.

Remember, financial education is a journey, and we are here to support you every step of the way. Zogo is just one of the many ways we strive to empower our members to achieve financial success.

2024 Scholarship Winners

Ed Thomas Community Service Scholarship Fund

Acclaim FCU is proud to announce that Natalie States has been awarded this year’s Acclaim FCU Ed Thomas Community Service Scholarship Fund. This prestigious scholarship is awarded annually to a student who has demonstrated exceptional academic performance, leadership, and commitment to community service.

Natalie has consistently demonstrated a dedication to excellence both in and out of the classroom. Aside from her outstanding GPA, she is in the Beta Club, National Honor Society, Spanish National Honor Society, and leads her school’s Campus Life/Youth for Christ club. Beyond academic achievements, Natalie exemplifies community service through her dedicated involvement in activities that reflect her passion for education and faith. Since 2021, she has volunteered in the Kindergarten room at her church, where she has attended almost all her life. Every other week, she spends an hour engaging with the children through games, crafts, and singing, fostering a nurturing and fun environment. This role is particularly significant to Natalie as it allows her to share her faith and values with the younger generation, building meaningful relationships with the children and encouraging their growth. Additionally, Natalie contributes her time to the Nighthawk Buddies program at Northern Elementary School, where she assists a first-grade teacher weekly, further demonstrating her commitment to education and community support.

This dedication to service exemplifies the values that Acclaim FCU seeks to promote and we are thrilled to award her the Ed Thomas Community Service Scholarship Fund.

She has shown outstanding academic and community leadership, and we are confident that she will continue to achieve great things in her future college endeavors.

Carolina's Credit Union Foundation Scholarship

Acclaim is pleased to announce that Marquarius Flythe has been awarded this year’s prestigious Carolina’s Credit Union Foundation Scholarship. Marquarius, a dedicated student and activist in the Black Student Union, has demonstrated exceptional leadership and a strong commitment to financial literacy and education.

In his scholarship essay, Marquarius reflected on the pivotal role his family played in shaping his understanding of personal finance. Their guidance in budgeting, saving, and investing laid a strong foundation for his financial literacy, which has driven him to set specific financial goals. These goals include covering college expenses in the short term and achieving long-term aspirations such as homeownership. Emphasizing disciplined saving and exploring investment opportunities, Marquarius is actively taking steps to secure his financial future.

Recognizing the importance of financial education, Marquarius highlighted the gaps in high school curricula that leave many students unprepared for real-world financial challenges. He advocates for mandatory financial literacy courses in high schools, covering essential topics such as budgeting, managing credit, and understanding student loans. Marquarius also suggests collaborations with financial institutions and community organizations to enhance these programs, offering students practical insights and mentorship opportunities.

His efforts reflect the values and mission of the Carolina’s Credit Union Foundation, making him a deserving recipient of this scholarship. Acclaim FCU and the Carolina’s Credit Union Foundation congratulates Marquarius Flythe on this well-deserved honor and looks forward to supporting his continued success and contributions to the community.

Safeguard Your Legacy: Introducing Exclusive Estate Planning Benefits

Secure Your Family’s Future with 20% Off an Online Estate Plan

We are excited to introduce a valuable new benefit exclusively for our members: the opportunity to secure your family’s future with an estate plan, now made easier and more affordable than ever.

In partnership with Trust & Will, a leader in online estate planning, we are pleased to offer you a 20% discount on any estate plan. Trust & Will has empowered over half a million families by providing simple, state-specific, and legally-valid estate planning documents. Their platform allows you to create a will or trust online in as little as 30 minutes, all from the comfort of your home.

Why Trust & Will?

- Affordable Services: As a member, you will save 20% on any estate plan and receive your first shipment of documents for free.

- Expert Support: Trust & Will’s team of experts is readily available to assist you with any questions you may have during the process.

- Easy and Convenient: With Trust & Will’s user-friendly interface and step-by-step instructions, creating your estate plan is straightforward and convenient.

- Customizable by You: Their documents are built by attorneys and are fully customizable to suit your family’s unique needs and state-specific requirements.

Creating an estate plan is a crucial step in ensuring that your wishes are carried out and your loved ones are taken care of. Whether you are considering your first estate plan or updating an existing one, Trust & Will and our credit union are here to support you every step of the way.

To take advantage of this exclusive member benefit, simply visit our Trust & Wills page and begin securing your legacy today.

We are committed to helping you protect what matters most. Don’t delay in securing your family’s future with an estate plan.

Budget-friendly Meals Under $8

Chicken Parmesan

Grab some fresh garden veggies to lighten this dish up for the summer

This gourmet dish will wow your family or guests without draining your wallet!

Ingredients:

For sauce:

- 2 T. olive oil

- 1 medium onion, chopped

- Kosher salt and freshly ground black pepper

- 3 cloves garlic, chopped

- 1 (28 oz. can) fire-roasted crushed tomatoes

For chicken:

- 2 1/2 C canola oil, for frying

- 1 1/2 lbs. chicken breasts, cut in half

- 2 large eggs

- 2 C. Panko breadcrumbs

- 4 oz. Parmesan cheese, grated (about 1 cup), divided

- 1/2 tsp. garlic powder

- Kosher salt and freshly ground black pepper

- 1 1/2 C. mozzarella cheese, grated

Directions:

- Make the marinara sauce: Heat oil in a medium saucepan over medium-low heat. Add onion and season with salt and pepper. Cook, stirring occasionally, until soft, 4 to 6 minutes. Add garlic and cook 2 to 3 minutes. Add tomatoes and bring to a boil. Reduce to a simmer and cook until the sauce has thickened, approximately 30 minutes.

- While the sauce simmers, prepare chicken: Season chicken with salt and pepper. In a bowl, beat eggs until frothy. In a second bowl, combine bread crumbs, 1/2 cup Parmesan, and garlic powder. Season with salt and pepper.

- Preheat oven to 350°F.

- Heat canola oil in a large cast-iron pan over medium heat until temperature reaches 350°F.

- Dredge chicken in egg and then in bread crumb mixture. When well coated, gently lower into oil. Fry, turning once, until golden brown and cooked through, 4 to 6 minutes.

- Arrange chicken in the bottom of an 8-by-8-inch broiler-safe baking dish. Top with marinara sauce, mozzarella and remaining 1/2 cup of Parmesan. Bake until warmed through, approximately 12 minutes. Switch oven to broil and broil until cheese is golden brown, about 1 to 2 minutes.

Yield: 4 servings

Prep time: 20 min.

Cook time: 55 min.

All You Need to Know About One-Time Password Scams

Identifying Threats and Staying Secure

One-time passwords (OTPs) are a crucial security feature in our digital age as an extra layer of protection for online transactions and account logins. But scammers are often trying to hijack these codes so they can steal sensitive info, money or both.

Here’s what to know about one-time password scams and how to avoid them.

What is a one-time password scam?

One-time password (OTP) scams seek to trick individuals into sharing their OTPs, which are then used by scammers to gain unauthorized access to accounts. Here are the various ways these scams go down:

- Phishing scams. Here, cybercriminals send fake emails or text messages appearing to be from legitimate sources, such as credit unions or banks, online retailers or social media platforms. These messages often contain urgent requests to verify your account or resolve an issue, prompting you to enter your OTP on a fraudulent website.

- Vishing (voice phishing). In this scam, scammers call victims and pretend to be from a reputable organization. They may claim there is suspicious activity on your account and request your OTP to secure it, all the while exploiting your trust and sudden sense of urgency.

- Man-in-the-middle attacks. In this method, attackers intercept communications between you and a legitimate service provider. When you request an OTP, the attacker captures it and uses it to gain access to your account.

Whichever method is used to steal your OTP, the scammer will then use it to access your accounts and possibly to steal your identity.

Red flags

Avoid falling victim to a one-time password scam by watching out for these red flags:

- Unexpected requests. Be cautious of unsolicited messages or calls asking for your OTP. Legitimate organizations typically won’t ask for your OTP unless you’re actively engaged in a transaction or login process.

- Urgency and threats. Scammers often create a false sense of urgency, claiming that immediate action is required to prevent something bad from happening, like an account suspension or fraud.

- Unusual sender information. Check the sender’s email address or phone number carefully. Scammers often use addresses or numbers that are slightly altered versions of legitimate ones.

- Suspicious links. Hover over links in emails or messages to see and verify the actual URL before clicking.

- Generic greetings and language. Scammers often use generic greetings like “Dear Customer” in their mass emails, which also tend to have spelling or grammatical errors.

Protect yourself

Staying safe from OTP scams requires vigilance and adopting best practices for online security. Here are some steps you can take:

- Never share your OTP.

- If you get a request for your OTP, verify legitimacy by directly contacting the organization.

- Use multi-factor authentication whenever possible.

- Be wary of links in unsolicited emails or text messages.

- Install security software.

If you’ve been targeted

If you think you’ve been scammed or shared your OTP, take quick action.

First, change the passwords on all affected accounts and those that have similar login credentials. Next, inform the host organization of the account that it’s been compromised. They can help secure your account and guide you on additional steps. Monitor your accounts in the ensuing weeks and months, looking out for any unauthorized activity. Finally, file a report with your local consumer protection agency, the FTC and the Internet Crime Complaint Center.

You may also want to consider identity theft protection at this time if sensitive information was compromised.

Stay safe!