We CONNECT

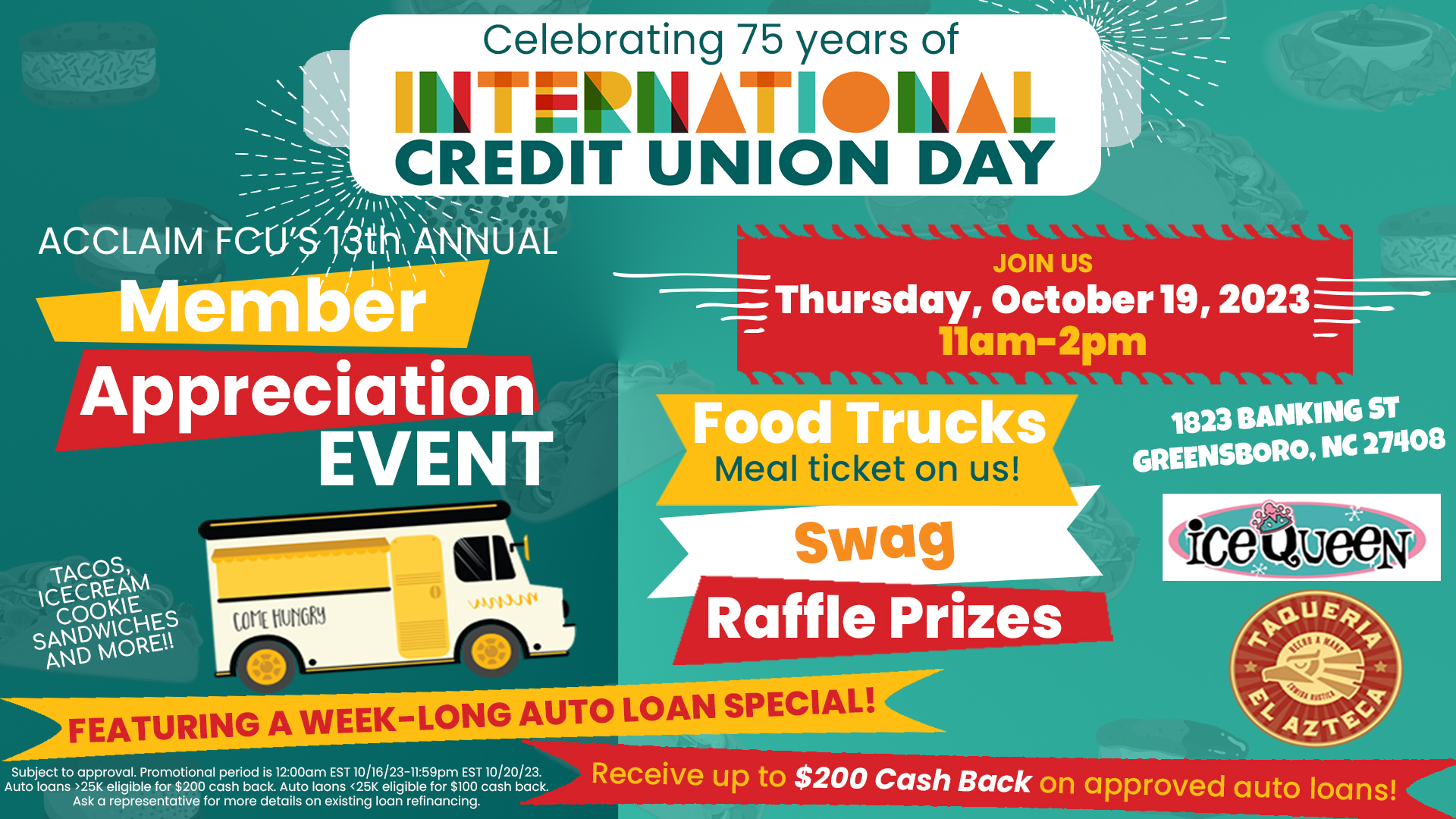

Join us for our 2023 Member Appreciation Day!

Featuring a 5-Day Auto Loan Special! Get up to $200 Cash Back on approved auto loans!

On October 19, 2023, Acclaim Federal Credit Union will join with thousands of credit unions around the world in celebration of International Credit Union (ICU) Day®. This year we are honoring 75 years of observing International Credit Union day around the world!

Come join us in-person at our credit union branch on from 11am to 2pm for food, fun, and free stuff! We will have not one, but TWO food trucks on site (and the food is on us!)

We will also be hosting an online Facebook giveaway raffle. To enter, you will need to visit our Facebook page between 12:00pm on October 12, 2023 and 12:00pm on October 19, 2023 and find our Facebook Giveaway post. Then, comment on the post’s question, “What are your top 3 financial tips?” and you will need to opt in to our notices by texting ACCLAIM to 888-794-1001, if you have not done so already. See official rules here.

In addition, we will be offering an incredible 5-day auto loan special! During the week of October 16th-20, 2023, approved auto loans will get up to $200 Cash Back! You can view the full details on our webpage here.

Fall Financial Prep: Smart Steps for Autumn

Seasonal Strategies for a Sound Financial Future

As the leaves change and the temperatures drop, it’s not just your wardrobe that needs a seasonal update—your financial plan could benefit from some attention this fall too. With the holiday season around the corner and potential weather-related expenses, here are some tips to help you prepare your finances for the autumn months.

1. Budget Review: Adjust your budget for seasonal expenses like heating and holiday spending.

2. Holiday Savings: Start saving early for holiday expenses to avoid last-minute stress.

3. Home Maintenance: Weatherproof your home to prevent costly repairs.

4. Insurance Check: Review and update your insurance policies as needed.

5. Retirement Boost: Maximize retirement contributions for tax benefits.

6. Emergency Fund: Ensure you have an adequate emergency fund for unexpected costs.

7. Benefits Review: Make informed choices during open enrollment for employer benefits.

Stay financially secure as you embrace the fall season. Small changes now can make a big difference later. Watch for more financial tips in upcoming newsletters!

Cultivating Financial Growth: Explore the Benefits of Acclaim FCU's Money Market Accounts

Discover the Power of Money Market Accounts at Acclaim FCU

Are you in search of a secure haven for your savings? Are you seeking an account that combines accessibility with an above-average rate of return?

While savings accounts are perfect for stashing away funds for emergencies or special purposes, checking accounts are designed for covering everyday living expenses. But what if there was a way to merge the benefits of a savings account with the convenience of a checking account into a single, exceptional account?

Look no further! Acclaim Federal Credit Union’s Money Market accounts offer convenient features coupled with an attractive rate of return to help your money grow more effectively.

Money Market accounts are tailor-made for funds you don’t require immediate access to but may need to withdraw portions of at some point in the future. With a Money Market account, you can earn a substantial return on your money without the volatility of the stock market or the restrictions of a savings certificate account.

It’s essential to note that most Money Market accounts have a minimum balance requirement. While some major banks demand a minimum deposit of $3,000 or more to open one, at Acclaim FCU, you can establish a Money Market account with as little as $2,500. As long as you ensure your balance stays above $2,500, you won’t incur any fees or penalties.

Still not convinced? Here are five compelling reasons to consider opening a Money Market account:

- Security: Funds in your Money Market account are insured by the NCUA for up to $250,000 and and an additional $250,000 through a private share insurance company. This means you can safely keep a substantial sum of money in your account without worrying about market crashes or poor investment choices. It’s a fantastic opportunity to save with confidence!

- Accessibility of Funds: One of the most appealing aspects of Money Market accounts is the liquidity of your funds. Money Market accounts have no maturity date or term requirement, granting you easy access to your money without penalties. However, there are limits on the number of transactions you can make each month. Acclaim FCU Money Market account holders can make up to [6] withdrawals per statement cycle. This accessibility makes Money Market accounts ideal for those uncertain about when they’ll need to access their funds, whether it’s for large, occasional expenses like tuition, emergency household repairs, or unexpected medical bills. You can also use it as a stash of spontaneous spending money or keep your quarterly tax payments in the account to earn more dividends while waiting to pay.

- High Interest Rates: Money Market accounts offer a rate of return that exceeds typical savings accounts. At Acclaim FCU, our APY for Money Market accounts can be as high as 5%APY* (accurate as of 9/1/23). This becomes especially beneficial in a rising interest rate environment, where rates are expected to climb. Give your money the opportunity to grow!

- Account Benefits: Like all our accounts at Acclaim FCU, your Money Market account comes with numerous benefits and attractive features. [There is no monthly maintenance charge for your Money Market account, and we won’t charge you a fee for ATM access within our network.] If you ever

have questions or concerns about your account, our friendly team is here to assist you. Whether you prefer to visit us in person, reach out through social media, or contact us by phone at 336-332-5302, a member service representative will be ready to help.

- Personal Checks and Debit Card Access: Money Market accounts offer flexibility. You can easily transfer funds to your checking account and use them to make payments via personal checks or your debit card. This flexibility allows you to access your money quickly and effortlessly, without waiting for a withdrawal to clear.

Are you ready to start saving more effectively? Open a Money Market account at Acclaim FCU today!

*From 9/1/23-3/31/24 get 5%APY on your money marketing with balances over $100K. APY- Annual Percentage Yield. Promotional rate valid 9/1/23-3/31/24. Fees may be charged to the account which could reduce earnings. Rates accurate as of 9/1/23. 0.00%APY on balances $0.00-$2,499. 2.00%APY on balances $2,500 – $10,000. 2.25%APY on balances $10,001 – $25,000. 2.50%APY on balances $25,001 – $50,000. 2.75%APY on balances $50,001 – $99,999. 3.00%APY on balances $100,000 and above. Standard rates apply after 3/31/24.

Acclaim FCU Scholarship Opportunity

Accepting Applications October 1 - February 1

We are delighted to inform you that our Ed Thomas Community Service Scholarship Fund will be open for applications from October 1st through February 1st.

This scholarship was established in tribute to Ed Thomas, a former Board Member who served in various capacities, including Chairman, during his tenure with us. Throughout his many years of exceptional volunteerism, he provided steadfast support and guidance, contributing significantly to the continuous growth and success of Acclaim.

In collaboration with the Carolinas Credit Union Foundation, Acclaim has streamlined the scholarship application process for our members, making it user-friendly and easy to manage. We have implemented a straightforward registration procedure that enables you to oversee your scholarship application through their dedicated portal.

Budget-friendly Meals Under $8

Mac ‘n’ Cheese Pie

It’s your kids’ favorite dinner reimagined in a pie!

Ingredients:

- 1 cup macaroni

- 1 tablespoon extra virgin olive oil

- 1 medium onion, diced

- 1 carrot, diced

- 1 pound ground beef

- 2 tablespoon gravy powder

- 3 ¼ cups tomatoes, diced

- 1 tablespoon Worcestershire sauce

- 1 ⅓ tablespoons butter

- 1 tablespoon flour

- 1 cup milk

- 1 cup shredded pizza cheese, divided

Directions:

- Preheat oven to 350°F.

- Cook macaroni according to package instructions in a large saucepan. Drain and return to pan.

- Heat oil in an oven-proof skillet over medium-high heat. Add onion and carrot. Cook, stirring frequently for 5 minutes, or until onion softens.

- Add ground beef and cook, breaking into small pieces with a wooden spoon for 6 minutes, or until browned.

- Stir in gravy powder, diced tomatoesand Worcestershire sauce. Bring to a boil. Reduce heat to low and simmer, uncovered, for 10 minutes, or until sauce thickens. Remove from heat.

- Meanwhile, melt butter in small saucepan over medium heat. Add flour and cook, stirring, 3-4 minutes, or until sauce boils and thickens.

- Stir in ½ cup cheese and season with salt and pepper. Add cheese sauce to macaroni and stir to combine.

- Spread macaroni mixture over ground beef and top with remaining cheese. Bake for 15-20 minutes, until golden.

Yield: 4 servings

Prep time: 20 min

Cook time: 1 hr

Pro tip: Spice it up with chopped green chilis or switch out the macaroni for your favorite pasta!h

Dismantling Debt Collection Deception

A Guide to Recognizing and Avoiding Financial Predators

No one likes to be in debt. It’s a downward spiral that never seems to end, and it’s an expensive burden to carry, too. Unfortunately, scammers often exploit the feelings of helplessness and overwhelm to lure victims into their debt-collection scams. Let’s take a look at these scams and how to keep yourself from falling victim.

How the scams play out

In a debt-collection scam, a scammer posing as a debt collector will call a victim and demand payment for an outstanding debt. The caller insists on a specific means of payment, usually a wire transfer or prepaid debit card. The scammer will sometimes threaten to tell the victims’ family members about the debt if it’s not paid up immediately. The alleged debt may be completely fabricated, or an actual debt the victim has that the scammer has learned about through social engineering or by hacking the victim’s private accounts. In either scenario, though, the caller is not a debt collector and represents only themselves. Of course, any money the scammer collects will go directly into their own pocket.

Red flags

Here’s how to recognize a debt-collection scam:

- The alleged debt collector demands immediate payment. A legitimate debt collector will always provide you with the option to dispute the debt and discuss payment arrangements.

- The caller insists on a specific means of payment. Scammers love having their victims cough up money through a payment method that cannot be undone, such as wire transfer or prepaid cards.

- The “debt collector” knows very few details about the debt. A genuine debt collector will have all the information on the debt and be able to answer any questions you may have.

- There is no contact information for the debt collection agency the caller allegedly represents. Ask for a phone number and street address for the agency. If none are forthcoming, it’s likely a scam.

Protect yourself

Debt-collection scams can be difficult to spot, but with the right knowledge, you can protect yourself. Follow these tips to stay safe.

- When called by an alleged debt collector, verify the debt. Request written validation of the debt, including detailed information about the creditor, the amount owed and the nature of the debt. Legitimate debt collectors should be able to provide this information.

- Never share personal information with an unverified contact. If you’re asked to provide sensitive information by an unknown contact, it’s likely a scam.

- Check for licensing and credentials. Debt collectors are often required to be licensed in the state where they operate. Research the collector’s credentials and licensing status through your state’s attorney general’s office or consumer protection agency.

- Know your rights. Familiarize yourself with your rights under the Fair Debt Collection Practices Act (FDCPA) and other relevant consumer protection laws. These laws outline the rules that legitimate debt collectors must follow when attempting to collect a debt. For example, they can only contact borrowers at reasonable hours, they cannot call them at their workplace, harass them about a debt using threats or violence, lie about money owed or falsify the name of the agency they represent, among other restrictions.

- Keep detailed records. Maintain thorough records of any communication you have with debt collectors, including dates, times, names and contact details. If you suspect a scam, these records can serve as evidence if you need to report the incident.

- Request written communication. Ask the debt collector to communicate with you exclusively in writing. Legitimate collectors should be willing to provide written documentation of the debt and any payment arrangements.

- Stay informed. It’s a good idea to check your credit report on a regular basis for any unfamiliar or fraudulent accounts. Monitoring your credit can help you quickly identify any unauthorized activities related to debt collection. It’s also advisable to keep up with the latest scams so you are better equipped to identify and avoid them.

Debt collection scams can make the nightmare of debt even worse. Use the tips here to stay safe!